Condo Insurance in and around Plano

Unlock great condo insurance in Plano

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

When considering different deductibles, providers, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including linens, shoes, pictures, and more.

Unlock great condo insurance in Plano

Quality coverage for your condo and belongings inside

Why Condo Owners In Plano Choose State Farm

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from water damage, an ice storm or vandalism.

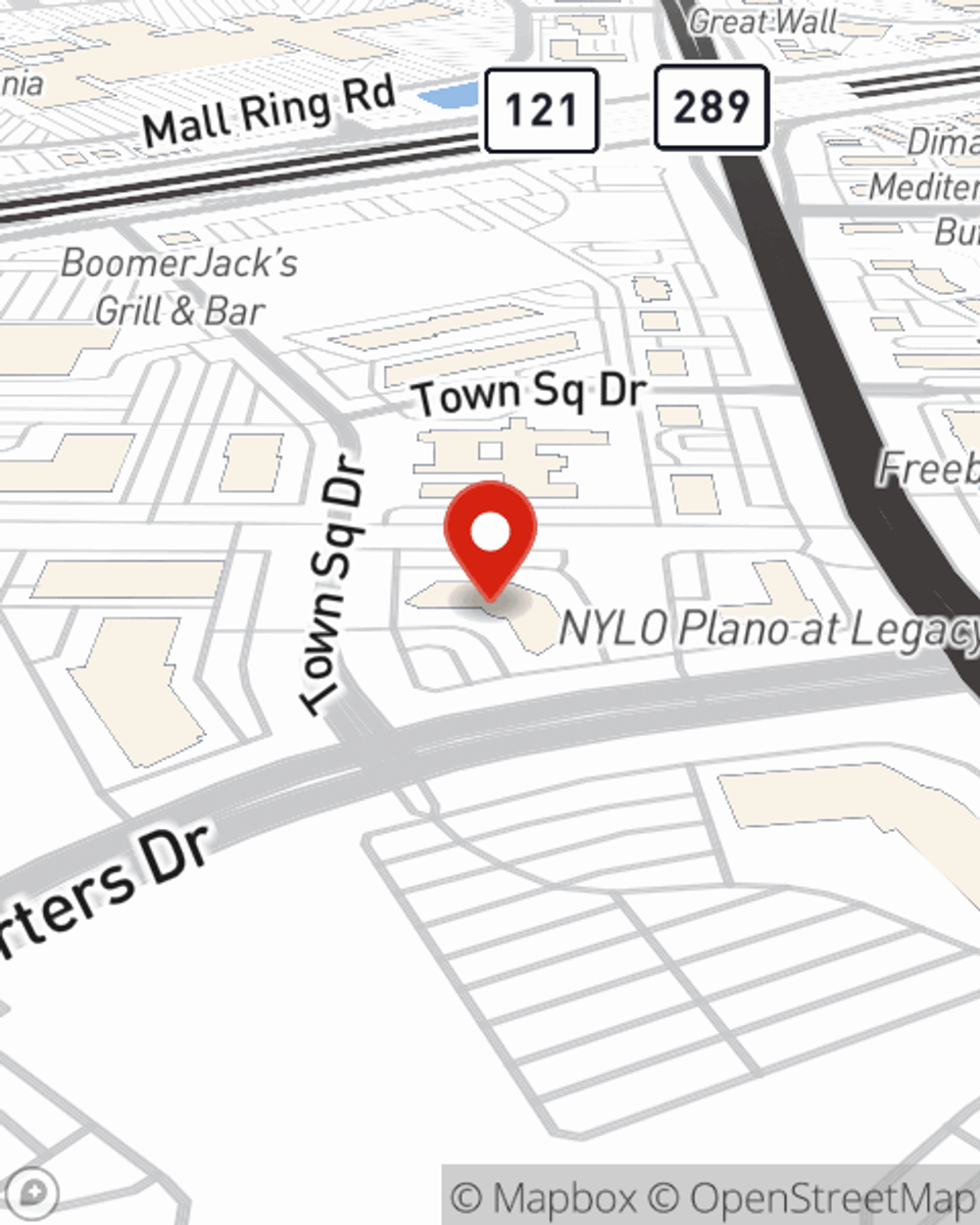

There is no better time than the present to visit agent Joe Jackson and discover your condo unitowners insurance options. Joe Jackson would love to help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Joe at (972) 690-9090 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Joe Jackson

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.