Business Insurance in and around Plano

Get your Plano business covered, right here!

Helping insure small businesses since 1935

Your Search For Reliable Small Business Insurance Ends Now.

Operating your small business takes commitment, time, and terrific insurance. That's why State Farm offers coverage options like worker's compensation for your employees, errors and omissions liability, extra liability coverage, and more!

Get your Plano business covered, right here!

Helping insure small businesses since 1935

Strictly Business With State Farm

At State Farm, apply for the excellent coverage you may need for your business, whether it's a clock shop, a gift shop or a psychologist office. Agent Joe Jackson is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

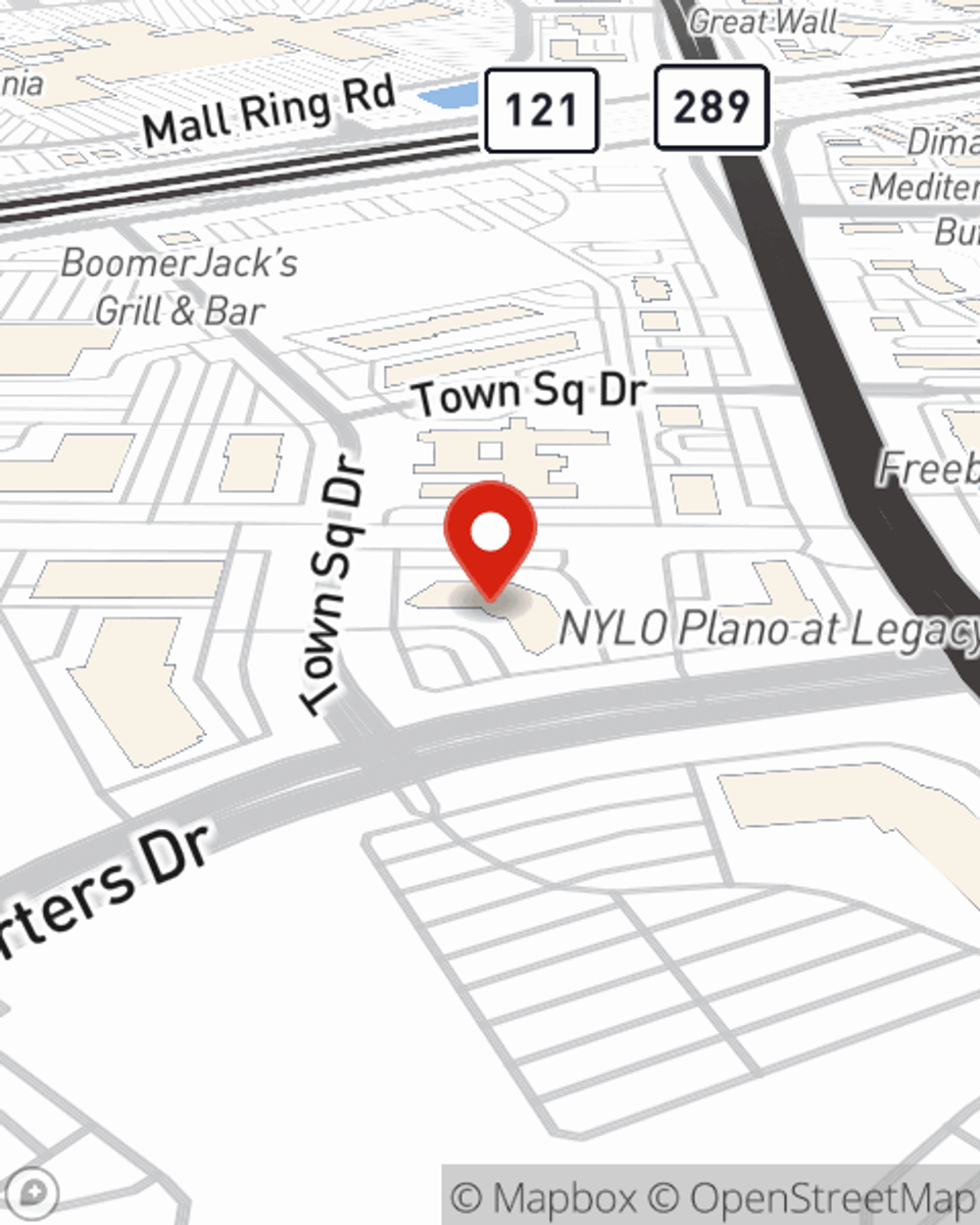

Contact agent Joe Jackson to review your small business coverage options today.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Joe Jackson

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.